- The Morning Grind

- Posts

- 🦷 Dentalcorp is done with public markets

🦷 Dentalcorp is done with public markets

Good morning. One dental practice has found a fun way to help their patients overcome fear of the dentist: a yellow labrador therapy dog that hangs out with them in the chair.

A friendly clinic dog probably does wonders for patient retention, too.

Inside this issue:

- Dentalcorp goes private

- Separating oral microbiome fact from fiction

⏰ Your reading time today: 6 minutes 41 seconds

🏆 Enjoy your coffee break with Word of Mouth, a dental-themed word game inspired by Wordle.

MARKETS

📈 3D Systems Corp ($DDD) – 3.17 | +0.22 (7.46%)

📈 Align Technology ($ALGN) – 131.50 | +6.10 (4.86%)

📉 Colgate-Palmolive ($CL) – 77.45 | -2.75 (3.43%)

📉 Dentsply Sirona ($XRAY) – 12.52 | -0.12 (0.91%)

📈 Envista Holdings ($NVST) – 20.63 | +0.42 (2.08%)

📉 Henry Schein ($HSIC) – 66.04 | -0.37 (0.56%)

📈 Straumann Holding AG (STMN.SW) – CHF 89.50 | +4.28 (5.02%)

📉 Weave Communications ($WEAV) – 6.78 | -0.090 (1.31%)

Data is provided by Google Finance. Stock data reflects market close at 5:00 p.m. ET, showing changes over the past five days.

THE DRILL DOWN

🤖 Planet DDS launches AI-native dental platform, introducing DentalOS™ with AI to enhance operational efficiency for DSOs and embed AI directly into critical operations, revenue cycle, imaging, orthodontics, and patient engagement. Talk about getting to the root of the problem.

🇨🇦 Canadian dental care program rollout improving, says the president of the Canadian Dental Association, but many patients still mistakenly believe their treatment will be free under the plan. Looks like there's still some plaque in the communication.

☹️ Over half of dental hygienists say they’re bullied in the workplace, including persistent criticism, humiliation, teasing, and threats, according to a new survey.

📱 South Carolina advances teledentistry bill, requiring in-person examinations and radiographic reviews before orthodontic treatments. Some smiles need more than screen time.

🏥 Florida reports a rise in emergency dental visits, with over 146,000 residents seeking care for preventable conditions in 2024 due to a lack of dentists in the state, particularly in rural areas.

📉 Georgia Medicaid child dental care participation continues to decline, with the Department of Community Health criticized for not implementing audit recommendations to improve access.

🎓 New legislation introduced in the Senate to make dental school tuition-free for students who commit to becoming general dentists in rural communities, as part of an effort to increase dental care access in underserved areas.

Enjoying this newsletter? Subscribe for free (zero spam, just sharp dental insights) at www.themorninggrind.com

CAPITAL MARKETS

Dentalcorp bought out in $1.6B take-private

Canada’s largest dental network—and aside from Park Dental, the only publicly-traded DSO—is leaving the public markets.

What happened: Dentalcorp, the 575‑practice giant that logged 5.6 million annual patient visits, agreed to a take‑private by GTCR, a Chicago-based private equity firm. The all-cash deal values Dentalcorp at C$2.2 billion ($1.6 billion) on an equity value basis, a 33% premium on the company’s closing stock price. Dentalcorp’s Founder and CEO Graham Rosenberg, and President and CFO Nate Tchaplia are both expected to stay in leadership roles.

Catch up: Dentalcorp was founded in 2011 and had grown to around 90 practices by 2014 when it raised C$121 million to ramp up its Canada-wide roll-up strategy. It went public in 2021 on the Toronto Stock Exchange, an offering the company called “the largest healthcare IPO in Canadian history.”

Public markets weren’t friendly to Dentalcorp, however. After a brief post-IPO pop, it saw its share price grind down around 40% from its public offering price.

Why it’s happening: Despite its struggle to generate much excitement in the public market, Dentalcorp has run a tight ship as it scaled operations, making it an attractive take-private for private equity (even at a healthy premium). So, how did they do it?

A repeatable acquisition engine. Dentalcorp built a programmatic M&A model, deploying more than $1 billion for acquisitions since the IPO, with a stated 15%+ return on invested capital (ROIC) target on practice purchases.

A streamlined integration process for new practices. Dentalcorp used a consistent playbook to align new practices’ tech stack and financial systems, team onboarding, marketing, and labor protocols. Management presentations highlight an immediate 10 to 15% practice‑level EBITDA margin uplift from cost synergies and a 10 to 15% expected increase in visit frequency post‑close.

Consumer demand and digital recall. A proprietary demand stack, including hellodent for search and online booking and “dc engage” for digital recall, is cited as driving an estimated 25% increase in visit frequency after acquisition.

Partner-dentist alignment, not replacement. Dentist partners retain clinical autonomy and, in many cases, take equity with non‑compete and non‑solicit covenants that help align incentives and stabilize revenue. Dentalcorp’s structure centralizes marketing, procurement, revenue cycle, IT, and training, while practices maintain a local identity.

Key takeaways: There are lessons in this deal for DSO leaders building with one eye on a possible acquisition down the road:

Be deal-ready on data and ops. Upgrade and streamline your tech stack so that you can centralize revenue cycle management, standardize imaging and charting, and efficiently integrate new practices. It’s good business practice for today and will improve your valuation tomorrow.

Lean into clinical adjacencies. Implants, specialty, and sedation dentistry continue to be growth levers. Platforms that can route cases across general and specialty at scale will see higher same‑practice revenue growth.

Keep equity aligned. Shared ownership remains a powerful retention and integration tool in competitive markets.

Bottom line: GTCR’s move is clear evidence that scaled, tech‑enabled dental platforms with disciplined M&A engines and payer readiness still command real premiums. Expect faster Canadian consolidation, renewed U.S.-Canada knowledge transfer, and a sharper fight for dentists and de novos. The winners will pair clinical excellence with industrial‑grade operations, then let the compounding do the rest.

Share this article: https://www.themorninggrind.com/p/dentalcorp-bought-out-in-1-6b-take-private

BUSINESS BITES

💼 Standard Dental acquires the assets of iCoreConnect, a cloud-based software company, enhancing its technological offerings for dental and medical practices.

💵 Corus Orthodontists secures an increased credit facility of C$250 million, up from C$175 million, which it says will help fuel further expansion in the orthodontic sector.

💰 Oregon-based medical device company TriAgenics extends its Series B-1 funding round due to heightened investor interest in its innovative, non-surgical approach to wisdom tooth prevention. Investors are biting—no extraction required.

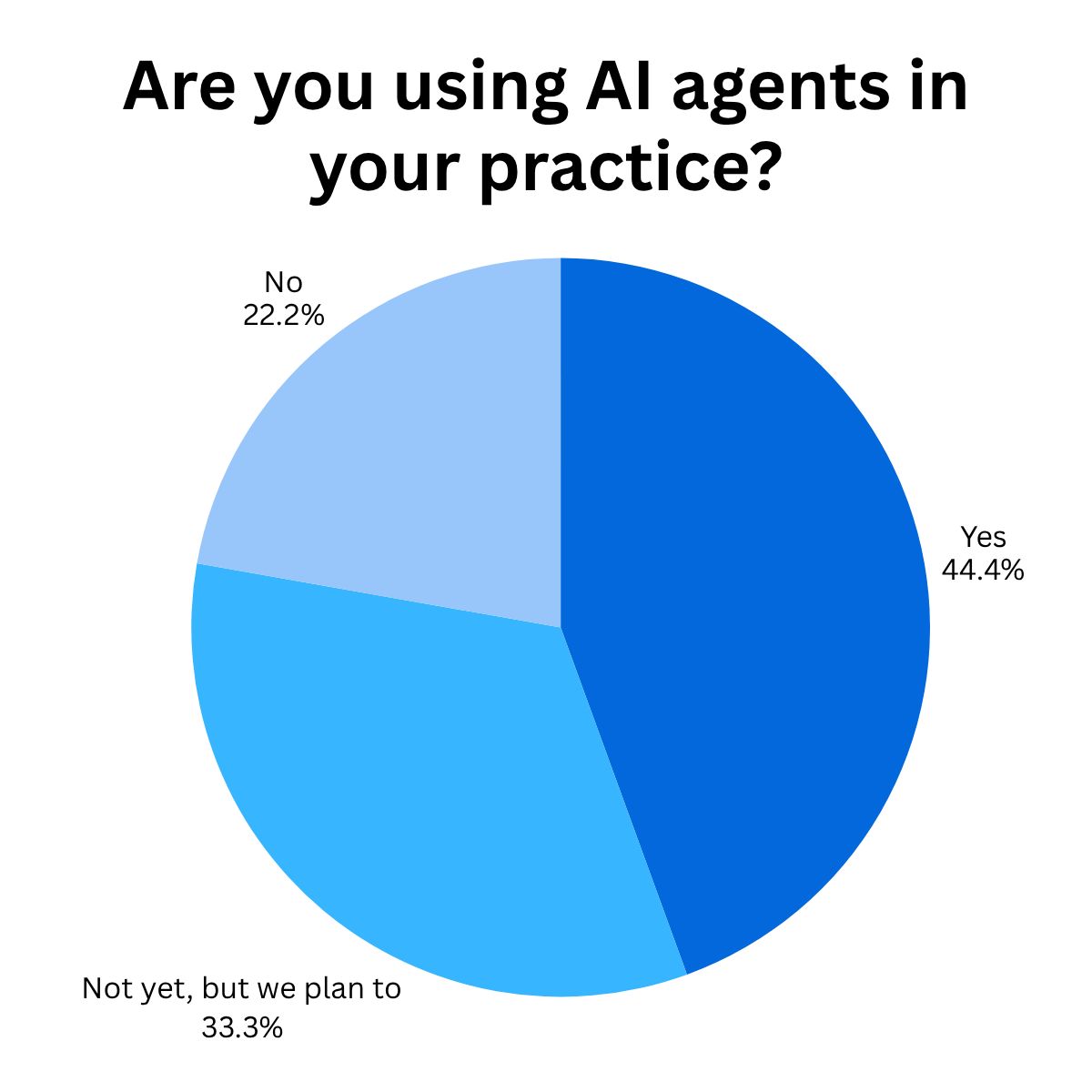

LAST ISSUE’S POLL RESULTS

Clinical Innovation

Bugs with benefits: Digging into the oral microbiome’s DSO moment

A lozenge that cools inflamed gums, a rinse that “feeds” good bacteria, and a saliva test that flags trouble before it bleeds: vendors promise a prevention flywheel and a fresh retail line at checkout. But how much can dental practices really leverage emerging science on the oral microbiome today? Time to map where the science stands and how DSOs can dip their toes in the water without buying snake oil.

What’s on the market: Dental practices now have a dizzying array of products to choose from that pitch themselves as oral microbiome boosters, including:

Probiotic lozenges, tablets, and mints that promise to freshen breath and support gum health

Probiotic and prebiotic toothpastes that claim to improve oral microbiome health

Rinses and mouthwashes that promise to support microbiome balance

Candies that claim to strengthen tooth enamel

A range of salivary diagnostic tests, including direct-to-consumer options that promise a personalized care plan

The state of play: Treatments and tests targeting the oral microbiome are showing some promising early benefits, but the evidence is uneven and practices looking to incorporate them will need to stay inside the regulatory lines.

Periodontal therapy: Recent meta‑analyses show modest, strain‑specific benefits when probiotics are added to non‑surgical periodontal therapy, but effects are inconsistent and often small. Several analyses favor Lactobacillus reuteri among tested strains, while others find non‑significant changes versus placebo. Translation: promise, not panacea.

Halitosis: Some studies show promise for using probiotics to treat halitosis by reducing VSC levels and improving saliva quality, particularly when combined with tongue scraping.

Diagnostics: Salivary and oral‑microbiome tests are moving fast, but clinical utility for caries or periodontitis risk stratification is not yet established in guidelines. That doesn’t mean practices aren’t incorporating these tests into their offerings. Smile Source recently announced salivary screening deployment in 800+ practices, a sign that chairside or send‑out testing will keep showing up in your referral network and patient expectations.

Regulations: When it comes to oral-microbiome tests, the ADA says there are no FDA‑approved saliva tests to evaluate patient risk for periodontal disease, caries, or head‑and‑neck cancer. Instead, most tests on the market are regulated by the Clinical Laboratory Improvement Amendments (CLIA) and marketed as wellness products.

What this means for you: Practices can credibly pilot targeted oral probiotics as adjuncts in narrow indications where the risk–benefit calculation makes sense, namely periodontal maintenance and halitosis programs. “Microbiome” diagnostics could be considered as decision support, but not as a diagnostic replacement.

🗳️ The Check-up:

⬆ VOTE: How often do you recommended oral-care products containing probiotics? |

CLINICAL NOTES

🦠 A bacterium known for causing tooth decay is linked to Parkinson’s disease in a new study, the first to demonstrate a microbial cause of the condition.

🥗 Adopting a Mediterranean diet may enhance gum health by reducing inflammatory markers associated with periodontal disease. Olive oil: what isn’t it good for?

🦷 Specific oral bacteria and fungi are linked to as much as a three-fold increased risk of pancreatic cancer in a large cohort study, suggesting oral microbial profiles could identify people at higher risk for the disease.

🔬 Researchers at NYU are developing a zinc-based treatment for cavities that could eliminate the need for drilling and avoid black staining that some existing non-invasive products cause. Now that would be a game changer.

FUN AND GAMES

BEYOND THE CUSP

New study shows dental training sharpens perceptions of facial beauty. No word yet on whether it also enhances facial beauty.

See the winners of this year’s Nobel prize in medicine.

Why there is a growing movement to let doctors prescribe travel.

Watch: Tourists are using robotic exoskeletons to climb challenging mountains in China.

Stressed at work? Try a mini meditation session.